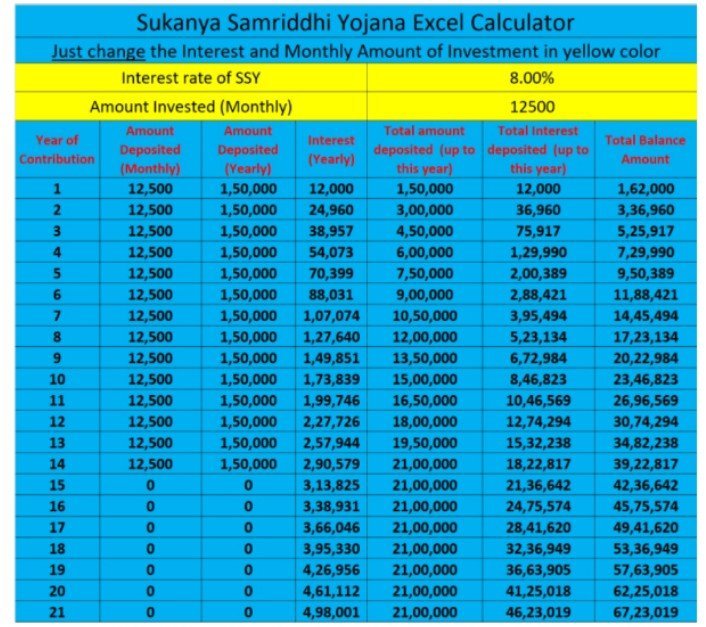

Sukanya Samriddhi Yojana (SSY) is a National Savings Scheme offered by the Government of India under the Ministry of Finance. The SSY is a small deposit scheme tailored specifically for the girl child.

It offers one of the highest rates of interest among small savings schemes backed by the Government of India. The rate of interest for Sukanya Samriddhi Yojana for the financial year 2024-2025 is 8.2% per annum, which is compounded annually.

Read Also:- વિધવા સહાય અરજી કરવા અને અન્ય માહિતી માટે અહીં ક્લિક કરો

What is Sukanya Samriddhi Yojana (SSY)?

Sukanya Samriddhi Yojana (SSY) is a scheme that promotes the Beti Bachao Beti Padhao (BBBP) campaign and is jointly run by the Ministry of Women and Child Development, the Ministry of Human Resource Development, and the Ministry of Health and Family Welfare.

SSY was launched in 2015 under the Government of India’s Beti Bachao Beti Padhao campaign, which aimed to promote the education of girls. It aims to build a savings fund for the girl child, with the interest accrued on maturity being exempt from income tax under Section 80C of the income tax act.

Read Also:- PM આવાશ યોજના અરજી કરવા માટે અને અન્ય માહિતી માટે અહીં ક્લિક કરો

The rate of interest for Sukanya Samriddhi Yojana for the financial year 2024-2025 is 8.20% per annum, which is compounded annually.

SSY can be opened through Post Offices, public sector banks, and three private sector banks : HDFC Bank, ICICI Bank, and Axis Bank.

Important links

ગુજરાતીમાં માહિતી માટે અહીં ક્લિક કરો

અરજી ફોર્મ માટે અહીં ક્લિક કરો

ઓફિસિયલ વેબસાઈટ પર જવા માટે અહીં ક્લિક કરો

સુકન્યા સમૃધ્ધિ ઓનલાઇન કેલ્ક્યુલેટર માટે અહીં ક્લિક કરો

The following are the primary targets of the Sukanya Samriddhi Yojana scheme:

- Ensures the protection and the survival of girls.

- Ensures that more girls participate in education and other areas.

- Ensures reduction in the practice of determining sex and gender discrimination against children.

Documents required to open an SSY account

The documents required to open an SSY account are listed below:

- Sukanya Samriddhi Yojana account-opening form.

- The birth certificate of the girl child must be submitted at the time of opening the account.

- The ID proof and address proof of the depositor must be submitted at the time of opening the account.

- A medical certificate must be submitted in case multiple children are born under one order of birth.

- Any other documents requested by the bank or post office.

Sukanya Samriddhi Yojana Eligibility

The Sukanya Samriddhi Yojana account eligibility are mentioned below:

- The parent or legal guardian can open an Sukanya Samriddhi Yojana account on behalf of a girl child until she reaches the age of 10.

- The girl child must be a resident Indian.

- In a family, up to two accounts can be opened for two girls.

- A third SSY account can be opened in case of twin girls.

Condition for Non-Payment of Sukanya Samriddhi Interest

The following are the instances when SSY account does not accrue interest:

- Make a minimum deposit of Rs.250 per year to keep the account active.

- A penalty of Rs.50 will have to be paid, in case the account becomes inactive due to non-payment of minimum deposit and interest will not be paid if penalty is not paid.

- Reduced rate of interest will be offered the entire amount of the deposit in such cases

- Interest rate of savings account which is lower than SSY would apply

- Extra interest amount paid before default will be deducted from balance amount

- After five years of opening the account, premature closure of account is allowable

- This premature withdrawal is allowed only in case of a medical emergency or a life-threatening condition

- The SSY interest rate would not apply if premature closure is done for any other reason

- Savings account interest rate would be applied only